Arrabawn’s record year

Arrabawn resilience and efficiency shows in challenging year for industry as record EBIDTA and Operating Profit achieved

2023 annual report also reveals shareholder funds reach five-year high while net-debt down to pre-expansion levels

Arrabawn Co-op continued its strong year-on-year trajectory over the past five years with a record financial performance across key metrics in 2023, its annual report reveals.

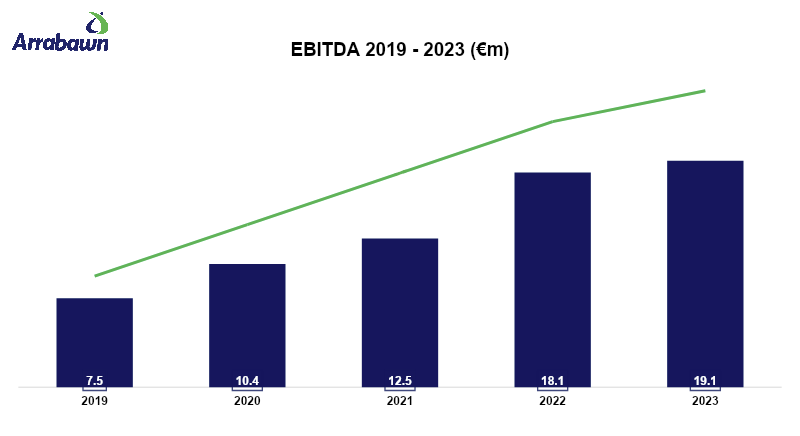

Despite a challenging market across all commodities, the company delivered record EBITDA (earnings before interest, taxes, depreciation, and amortization) of €19.1million for 2023. This was up 5.5% on 2022.

The EBIDTA outcome also underscores the return from the company’s record investment programme at its Nenagh processing facility across the past decade, with the performance up 233% on five years ago.

The strong 2023 performance was also reflected in a record Operating Profit of €10.77million which was up €1.19m (12.5%) on 2022.

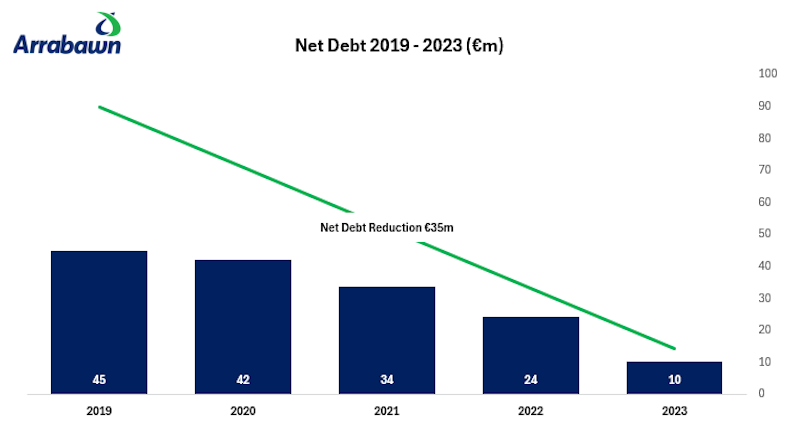

The company balance sheet was also significantly improved, with shareholders’ funds increased by 11.5m, a 51% increase on five years ago, while net debt brought about by the investment programme is now down from a high of €45m in 2019 to €10.3m last year, a decrease of €13.8m on 2022 and now at pre-expansion levels.

The co-op also delivered a strong milk price of 43.77c/lt, supporting suppliers in an otherwise challenging year of difficult weather conditions and persistently high input costs.

An exceptional item, not recorded in either EBIDTA or Operating Profit, was the profit of €4.3m from the sale of the liquid business in Kilconnell last year.

The company’s Agri Trading Division also continued to grow its customer base across 2023, thanks in no small part to the company’s bonus shares loyalty programme, while other retail division sectors also showed solid growth.

Arrabawn completed a €3m extension to its Dan O’Connor Feeds mill in Limerick in 2023, while the capital expenditure programme also saw investment in the new entrance at its Nenagh headquarters, including new intake and CIP (Cleaning in Place for trucks) areas as well as water and heat recovery.

Commenting on the performance, Arrabawn CEO Conor Ryan said, “After the exceptional year in 2022 for dairy markets, 2023 proved much more challenging with a drop in dairy commodities, in particular. Turnover was down as a result, but the value add from our record investment programme was reflected by the record EBIDTA and Operating profit, both excluding exceptionals. This is a very encouraging outcome. Our single exceptional item was the sale of our Kilconnell facility and we are grateful to the people who worked with us in this business and on the transition. Overall, Arrabawn has achieved high levels of efficiency and sustainability and is well placed for the future.”

Chairman Edward Carr said, “2023 was a challenging year for farmers through weather conditions, input costs and reduction in farm gate returns. However, Arrabawn’s strong performance helped bolster against the worst of this by way of a very competitive milk price. It is also encouraging for our suppliers to see the financial performance of the co-op so strong, including a significant increase in shareholders’ funds. This endorses that the investment put in place is really working for our members.”